Obligation to notify a merger and key aspects of merger control

Key aspects of merger control

Unlike mere cooperation between companies, a merger involves a stronger and usually permanent structural link between two or more companies, commonly established under company law.

Company mergers are a common means for companies to reach strategic business goals. For example, a merger can help to gain access to new markets or customers, expand a company’s own product portfolio, secure sales channels or supplies, and develop synergies.

However, some mergers may restrict existing competition, for example when a company takes over a direct competitor. Such mergers may result in merely a few or even only one supplier being left in the market. An impairment of competition can lead to higher prices, poorer quality and less innovation, as there are no longer sufficient alternative suppliers for customers to choose from.

For this reason, the Bundeskartellamt examines mergers of a certain size which have an effect on the German market.

Which mergers have to be notified?

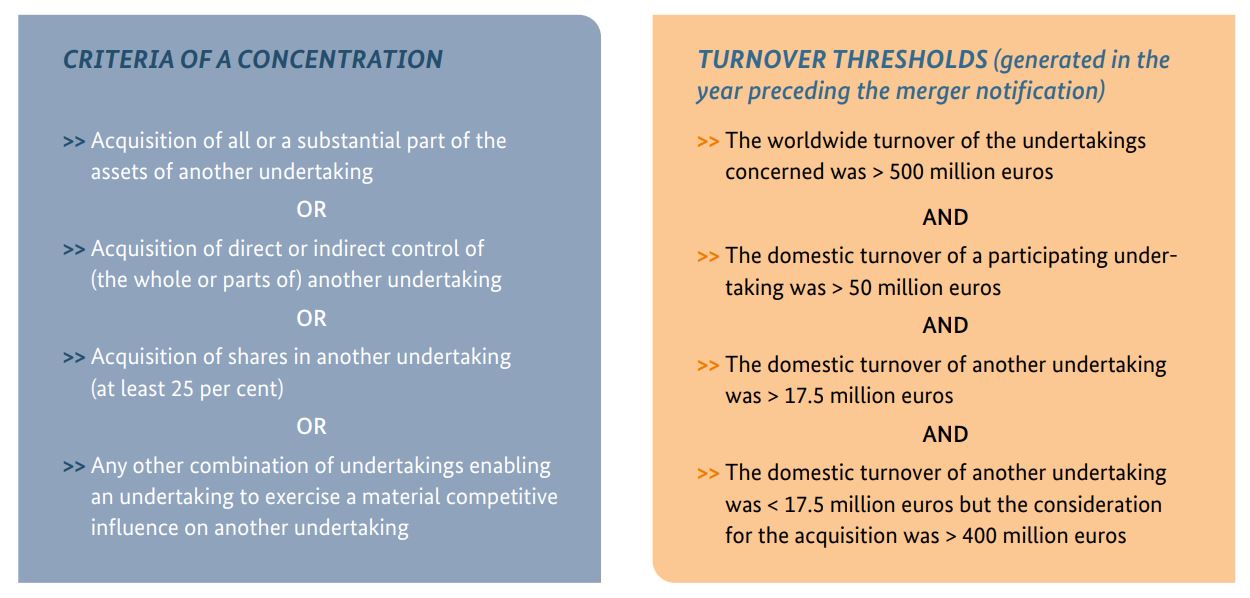

Not every merger between companies has to be submitted to the authority for review. The merger project has to be a concentration as defined by law and the companies concerned must have reached certain minimum turnover thresholds the year preceding the merger.

What is a “concentration” as defined by law?

A concentration as defined by law does not exclusively refer to a complete takeover, a merger or a majority shareholding. In some cases, the acquisition of a minority interest can also qualify as a concentration. This is the case, for example, if at least 25 per cent of the voting rights or capital shares of another company are acquired. Any other link between companies also constitutes a concentration if it enables the acquiring company to exercise a competitively significant influence on the other company. The acquisition of significant assets, such as a production site or a business division, can also constitute a concentration as defined by law.

What turnover thresholds do the merging companies have to meet?

Merger projects are only subject to examination if they reach a certain economic size. The merging companies must have a combined aggregate worldwide turnover of more than 500 million euros. At least one of the companies must have a turnover of more than 50 million euros and another of more than 17.5 million euros in Germany.

Transaction value threshold

Following its 9th amendment in June 2017, the German Competition Act (Gesetz gegen Wettbewerbsbeschränkungen – GWB) stipulates that mergers involving the acquisition of a company whose turnover achieved in Germany is less than 17.5 million euros but whose operations in Germany are substantial are nevertheless subject to merger control where the value of the consideration (usually the purchase price) exceeds 400 million euros. On the basis of this provision, the Bundeskartellamt may also examine mergers where large incumbents acquire small companies which have so far generated no or very little turnover but are nevertheless of great relevance to competition (for example, due to their innovative strength). Acquiring such a company could create or strengthen a dominant position or otherwise result in the merger significantly impeding effective competition.

Special case – Request for notification

Under certain conditions the Bundeskartellamt can request companies to notify mergers in certain sectors of the economy even if they do not meet the turnover thresholds. However, this requires indications that future mergers of or takeovers by this company could significantly restrict competition in these sectors. Prior to issuing such a request, the Bundeskartellamt must have conducted a sector inquiry in one of the economic sectors affected.

Merger control by the European Commission

Mergers with a “Community dimension” are examined by the European Commission and not by the Bundeskartellamt. As a rule of thumb, concentrations are examined in Brussels if the combined turnover of all companies involved is higher than 5 billion euros. The exact thresholds are set out in the EC Merger Regulation.

Under European law it is also stipulated that individual cases may be referred to the European Commission by a Member State or to a Member State by the European Commission, irrespective of the turnover achieved by the companies involved. This depends on whether the merger mainly affects the territory of a Member State or has a cross-border dimension.

The European Commission provides an overview of EU merger control on its website.

How to notify a merger

Businesses can notify a merger to the Bundeskartellamt by post (Kaiser-Friedrich-Str. 16, 53113 Bonn), by fax (+49 228 9499-400) or electronically. Electronic notifications can be submitted

- by email, bearing a qualified electronic signature, to fusionskontrolle@bundeskartellamt.bund.de;

- by De-Mail to fusionskontrolle@bundeskartellamt.de-mail.de;

- or via the special electronic mailbox for German public authorities (beBPo).

Please note: Notifications by regular email do not meet the statutory requirements and do not trigger the time limit for merger control proceedings. More information on electronic communication with the Bundeskartellamt and on filing merger notifications electronically can be found here.

Merger control in figures

-

804

... mergers were notified to the Bundeskartellamt in 2023.

-

6

... second-phase proceedings were concluded in 2023.

-

160

... days was the average duration of second-phase proceedings in 2023.